2023 Q4 Review and Outlook – The Dog That Didn’t Bark

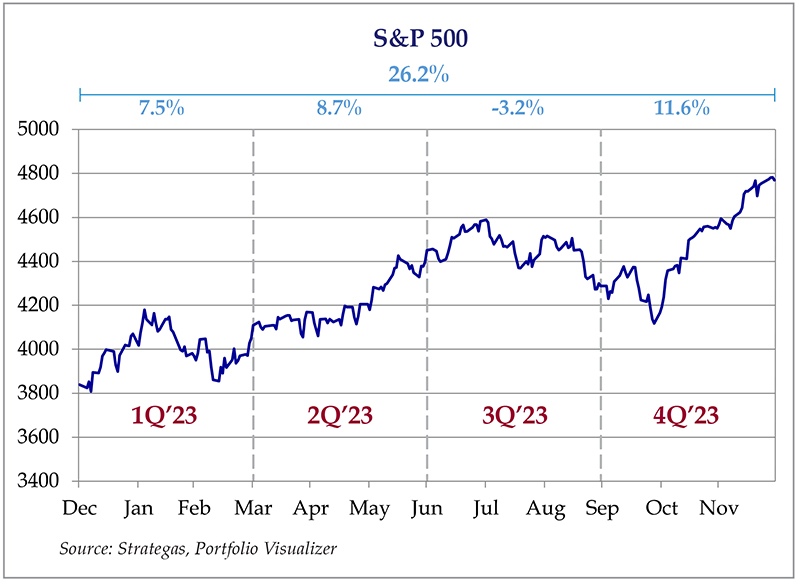

Markets finished the year with a powerful surge as stocks (as measured by the S&P 500 SPDR ETF – SPY) gained 11.6% during the fourth quarter. The U.S. bond market (as measured by the US Aggregate Bond ETF – AGG) increased 6.8%, and a 60% stock/40% bond portfolio booked a 9.7% total return. For the year, stocks returned a spectacular 26.2%, bonds increased 5.6% and a 60/40 portfolio gained 18.0% – a far cry from 2022’s poor performance.

Figure 1: S&P 500 quarterly performance, trailing four quarters.

The Dog That Didn’t Bark

There is a famous Sherlock Holmes mystery titled “The Dog that Didn’t Bark.” In this story, something that didn’t happen provided Inspector Holmes the key clue to solve the mystery. In 2023, the “dog” that didn’t “bark” was a recession that was all but guaranteed by most economists. Instead, the economy hung on by its fingernails while inflation continued a slow march back to a more tolerable rate.

Meanwhile, the stock market, which had taken a vicious beating in 2022, was already priced for the “inevitable” recession in January. Furthermore, bonds were priced for a long period of high inflation, which meant misery for all investors as 2023 began. However, the recession forecast was pushed back a quarter, then another quarter, then serious talk of the mythical “soft landing” started to appear, and that’s all investors needed to hear to drive the S&P 500 and the NASDAQ back to new highs. Bonds also made a nice contribution to portfolio returns as the “bear steepener” (which we discussed in our last update) reversed late in the year as it became clear that the Federal Reserve was becoming more dovish.

This does not mean that there is no more risk to the economy. The “stuff” economic indicators are still very soft, and the unemployment rate seems to be ticking up from its 40-year low. We could easily have a recession in 2024 (especially since many forecasters are now saying “soft landing”). However, the Federal Reserve appears to be more willing to provide support now that inflation has cooled off a bit.

So the next time someone asks you why the stock market did so well in 2023, you can say “stocks went up because nothing happened,” and you would be as right as any investment strategist on CNBC.

It was a very profitable 10 years – for those who held through the drawdowns

Not only was 2023 an excellent year for investors, the past decade was also a great time to own stocks, as the S&P 500 recorded a 13.6% average annual return – which would have roughly quadrupled an investment in SPY on January 1, 2013 (including reinvested dividends). The returns did not come without volatility, however, as the same stock investor endured two drawdowns exceeding 20% (in 2020 and 2022) and a 19% peak to trough decline in 2018 (almost all which happened in the fourth quarter – Santa Claus put coal in investors’ stockings that year.)

While the outstanding 10-year performance record seems “easy” in retrospect, people tend to forget how they felt during those drawdowns. Not too many investors were rushing to buy stocks in March 2020 or October 2022. Instead of adding to stock positions during these low points, investors were saying “there’s too much uncertainty right now,” or, “let’s wait until the coast is clear.” Has there ever not been a lot of uncertainty? By the time the “coast was clear” (whatever that means), the market had already recovered.

Inflation – Inching back down the mountain

The December inflation report just came out and the growth rate of the Consumer Price Index (CPI) fell again, to 3.4% from 3.7% in September. In past reviews, we expected continued improvement in the inflation numbers, owing to a) a tightening Federal Reserve and b) a decline in the money supply from more conservative banks with increasing funding costs and higher defaults. Less money + more “stuff” = lower prices (all else equal!) The latest CPI report confirms our expectation of “trend is still favorable, but it’s taking its time.”

The “Core CPI” index (which excludes food and energy and includes 80% of the CPI) continues to move more sluggishly than the “headline” CPI, falling to 3.9% from 4.1% in September. As anyone who has tried to buy a house or rent an apartment has seen, shelter inflation continues to be the largest contributor to both the Core and headline CPI values. However, CPI housing data lags the real-time trends, and private rent tracking services have reported a distinct moderation in rental rates over the past 3-6 months.

While the Core number is still higher than the headline number and much higher than the Federal Reserve’s 2.0% goal, the trend remains encouraging, and we haven’t seen Core CPI growth this low since mid-2021.

Since the inflation trends are continuing in the right direction, we believe that the Federal Reserve will become increasingly “accommodative,” especially if the economy continues to slow. While the Fed is currently “paused” with regard to interest rates, there is a strong expectation of some rate cuts in 2024. This should hopefully provide some relief to mortgage rates, although lower mortgage rates could quickly translate to another round of rising house prices as buyers re-enter the market.

The Election – don’t go to cash if the “other” party wins

In case you haven’t noticed, there is a presidential election at the end of this year. Investors always get excited about elections, because they believe that “their” party’s candidate is going to be better for the economy and the stock market than the “other” party’s candidate. The 2024 election may prove to be a repeat of 2020 with the same candidates but with even more drama, so hold on for a very interesting year.

The conventional wisdom is that Republican presidents are more business-friendly and will therefore create a more dynamic economy with less red tape, lower taxes, etc. – which means big stock market gains for everyone. Meanwhile Democratic presidents raise taxes, strangle businesses with regulations and demand May Day parades to celebrate the rise of the proletariat. As a result, investors should sell all their stocks, buy gold, and run to the hills if a Democrat sits in the White House, but mortgage their house to buy stocks if a Republican president is elected.

However, as Lee Corso from College Game Day would say – “Not so fast my friend!” The historical data tells a different story. Based on an analysis by investment research firm Strategas, average stock market returns are statistically the same between Republican and Democrat presidents. Furthermore, since the stock market posted a positive return in the majority of four-year terms, going to cash when the “other” party is elected would have been a huge drag on long-term returns.

Why is this the case? There are many reasons. The following list just hits the highlights:

- The economy is bigger than the White House. The world economy is a massive object with a lot of momentum. There are wars and pandemics, and the economy is so globalized that economic trends aren’t all started in the U.S. anymore. As a result, many presidents’ policies are washed out by larger economic forces. George H.W. Bush increased taxes shortly before a mild recession (“Read my lips. No. New. Taxes!”) and was run out of office. Meanwhile, his replacement Bill Clinton raised taxes again during a massive economic expansion and was lauded as an economic genius. More recently, Donald Trump cut taxes and the economy did pretty well – until COVID hit and everything fell apart.

- Starting valuations matter. The stock market reflects expectations of the future economy, but it often behaves much differently from the current Some of this effect can be attributed to valuations. If stocks are cheap, expectations are low, so even the slightest positive trend in the economy can generate good returns for investors. Likewise, when stocks are expensive, everything must go right to continue the trend. All presidents will start with a headwind or tailwind of high or low expectations. Right now, stocks are expensive (but are far from “bubble” territory) so the next president will have a moderate headwind. Here are a few past examples: A. When Ronald Reagan took the reins in 1981, stocks were dirt cheap. The Dow Jones Industrial Average had a P/E of less than 10. Nobody wanted to own stocks. B. Conversely, George H. W. Bush entered office following the “Reagan Revolution” and a long stock market run which resulted in lofty expectations for the future. C. George W. Bush was inaugurated as the tech bubble was bursting, then was hit with 9/11. D. Barack Obama took over in the depths of the financial crisis, when the financial world was falling apart, and expectations once again hit rock bottom.

- Gridlock seems to help. What seems to work best (by a small margin) is when one party controls the White House while the other controls at least one part of Congress. (Which is coincidentally the current situation.) This makes sense, because it implies that only the “best” bills make it into law, as the balanced opposing forces compromise on more radical elements of policy. Think about how Ronald Reagan had to work with Tip O’Neill during the 1980s, or when Newt Gingrich hammered out the “Contract with America” with Bill Clinton in the 1990s.

Another interesting aspect about elections is how the markets ebb and flow during the four years of the election cycle – particularly the fourth year (the year of the election). If the current cycle is consistent with the past, then 2024 could be a decent year for stocks. According to another study by Strategas (who has one of the best political analysis groups in the industry), the stock market only declined during two election years since 1932 when an incumbent ran for re-election. (He didn’t have to win – just that he went for a second term). For example, the S&P 500 returned 18.4% in 2020, when President Trump ran for re-election (which is even more remarkable considering everything that happened that year). The last negative year was 1940, when FDR ran for a third term and World War II had just broken out. We believe that some of this effect can be attributed to the incumbent using his political power to literally bribe voters by avoiding risky or controversial economic decisions and otherwise spending freely.

If you’ve been reading our reports regularly, you probably know what we’re going to say – don’t trade on this analysis! If anything, it should make you more long-term oriented, because sometimes the market doesn’t do what you expect it to do, despite what “logic” or “economics” or “investment strategists” say. Make a long-term financial plan, and invest according to that plan, not to what Fox News/CNN/CNBC scares you into doing. Also, despite our indifference to the White House occupant from an investing perspective, we strongly encourage everyone to vote – it’s a privilege that, sadly, most people around the world don’t have.

We hope everyone stays warm and dry this Winter, and we will we back with another update when the flowers bloom in April. Please contact us if you have any questions.