2023 Q2 Review and Outlook – A Market of (Seven) Stocks

The positive momentum continued in the second quarter as stocks (as measured by the S&P 500 SPDR ETF – SPY) gained 8.7%. The U.S. bond market (as measured by the US Aggregate Bond ETF – AGG) lost 0.9%, and a 60% stock/40% bond portfolio returned 4.8%. Year-to-date (YTD), stocks returned 16.8%, bonds 2.3% and a 60/40 portfolio 9.9%.

Figure 1: S&P 500 quarterly performance, trailing four quarters.

The “Stock Market” is currently seven stocks

The stock market’s quarterly and year-to-date performance has been impressive, especially considering what investors experienced in 2022. However, the “stock market” can mean a lot of different things, depending on what specific stocks are in your portfolio. Even passive index fund investors have experienced a wide range of returns in 2023, and the disparity hasn’t been this wide since the peak of COVID-19.

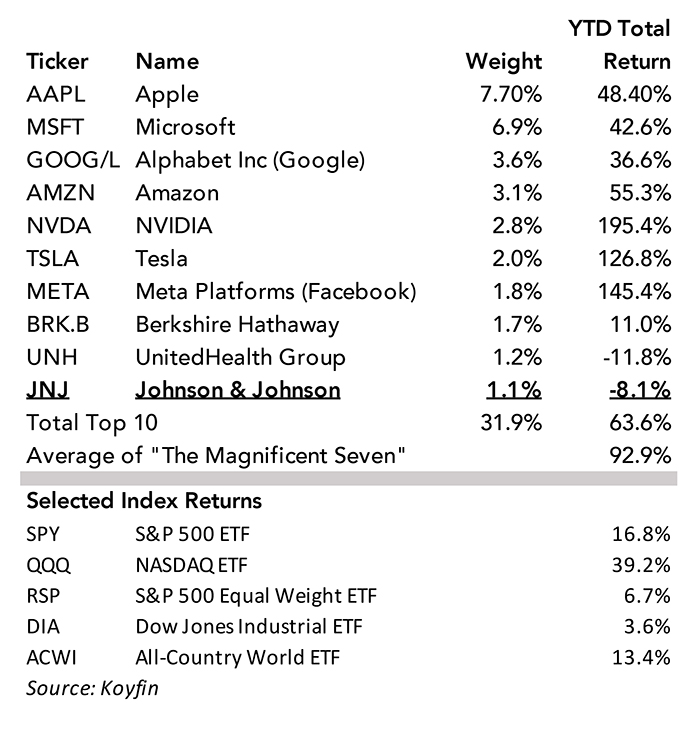

The main driver of this phenomenon is the extremely narrow nature of the stock market rally. It has been dominated by a few very large technology companies, which some investment strategists have termed “The Magnificent Seven.” (Movie buffs of a certain age will get the reference.) These seven stocks include Apple, Microsoft, Alphabet (Google), Amazon, NVIDIA, Tesla and Meta (Facebook). Their average year-to-date total return (to July 7th) was a breathtaking 93%, With NVIDIA returning 195%.

Outside of The Magnificent Seven, returns have been much more pedestrian. For example, an investor who simply owns all the S&P 500 stocks in equal amounts earned a 6.7% return – much lower than the S&P 500’s 16.8% return. Why is there a 10 percentage point difference? Stocks in the S&P 500 are weighted by market value, and the best performing stocks were also the largest. This has made the S&P 500 very “top-heavy,” and the top 10 stocks now make up over 30% of the S&P 500 – one of the highest concentrations in the history of the index.

Figure 2: S&P 500 Top 10 Holdings and Year-to-Date Return (to 7/7/2023)

This presents portfolio managers with a problem, because investing almost 8% of the client’s entire equity portfolio in Apple and almost 7% in Microsoft results in some quite concentrated positions. Both companies are fantastic companies and we own both of them (as well as Amazon, UnitedHealth and Johnson & Johnson) in our model portfolios, but there are a lot of other great companies out there in other sectors. The top seven stocks are all tech or tech-related as well, and investors felt the pain of the tech crash in 2022. As a result, we (and almost every non-S&P 500/non-big tech portfolio) underperformed the index in 2023. The Dow Jones Industrial Average – which has had very similar returns to the S&P 500 for decades – underperformed by 13 percentage points. That is a huge disparity.

The concentration has become even more extreme in the NASDAQ 100, where the Magnificent Seven now make up 55% of the index. The situation has become so extreme that the NASDAQ is going to perform a “special rebalancing” to reduce the aggregate weight of the top five stocks to under 40%. There have only been two other rebalancings in the history of the index – 1998 and 2011. (Source: Investor’s Business Daily).

Stock returns depend a lot on the starting point

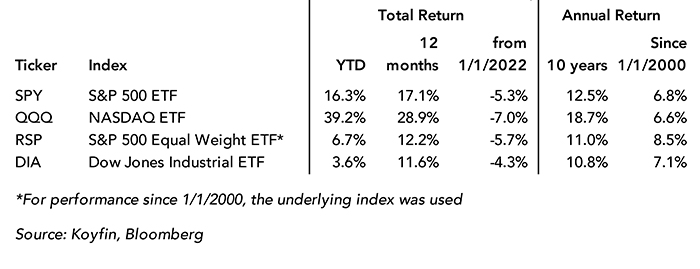

Speaking of time horizons, the other lesson that stocks are teaching us this year is how easily our perception of “underperforming” or “outperforming” changes when we look at different starting points. Figure 3 shows the performance of four major stock indices over varying time frames, and the relative results are all different depending on when you start the race.

Figure 3: Selected Stock Index Returns to 7/7/2023

Looking just at the YTD and trailing 12 month results, “big” and “tech” clearly dominate. However, if you move the starting point back to January 2022 (which was the most recent market top), the results flip, with the NASDAQ having the worst returns. Despite the huge jump over the past 12 months, tech stocks were just digging themselves out of a deeper hole than the more diversified portfolios.

If you extend the timeframe even further, you get a similar phenomenon. Looking back 10 years, the best strategy was simply to put everything into the NASDAQ and forget you owned it. Nothing else came close to the QQQ’s 18.7% annual return. However, if you had made the same decision in January of 2000 (when everybody and their brother was rushing into tech stocks), you would have had the worst performance. The best performing index on this list over the past 23 years was the equally-weighted S&P 500, by a fairly wide margin.

High expectations sometimes result in low returns (and vice-versa)

What was so different between January 2000 and July 2013? Expectations. In late 1999 people were dumping every penny into tech stocks, believing that the “new economy” was going to leave the boring “old economy” stocks in the dust. As a result, tech stocks became very expensive and “boring” stocks were “on sale.” Then the “tech wreck” crushed the NASDAQ (which fell about 80% from top to bottom) as expectations came back to earth. They managed to get some traction again but crashed in the 2008-2009 financial crisis with everything else. In 2013, expectations were still very low – especially among the “mega cap” tech stocks like Apple and Microsoft. Both companies had stumbled, and you could have bought either stock for less than 15 times earnings. Then they made changes and reignited growth, and everyone is happy again. How much are you paying for a dollar of profits now? About 30x for Apple and 32x for Microsoft.

This pattern is similar for many of the other “Magnificent Seven,” especially NVIDIA. NVDA shares were selling for less than 15x earnings in July 2013. Now you have to pay 50x earnings. Of course, NVIDIA’s growth has accelerated with the growth of Artificial Intelligence (AI), which is the latest hot trend. While we believe that AI will change many aspects of business and society, we also believe that the actual path to this change is unpredictable, and the “winners” may not be the companies or stocks that we expect. Every new technology goes through the same evolution. Hundreds of companies sweep in to exploit the invention, and most of them fail. Even the winners must go through some tough times and adjust along the way.

The lesson here isn’t “sell your tech stocks” – it’s more of a suggestion to maintain a diversified portfolio across many sectors (and even across countries), to focus on longer timelines across different market cycles and to avoid jumping on the bandwagon of every hot trend.

Inflation is slowly deflating

In past reviews, we expected continued improvement in the inflation numbers, owing to a) a tightening Federal Reserve and b) a moderation in bank lending as a result of the Silicon Valley Bank debacle – with both contributing to a decline in the money supply. Less money + more “stuff” = lower prices (all else equal!) Based on the June Consumer Price Index (CPI) report (released on July 12th), the inflation trend is going the way we thought it would – down.

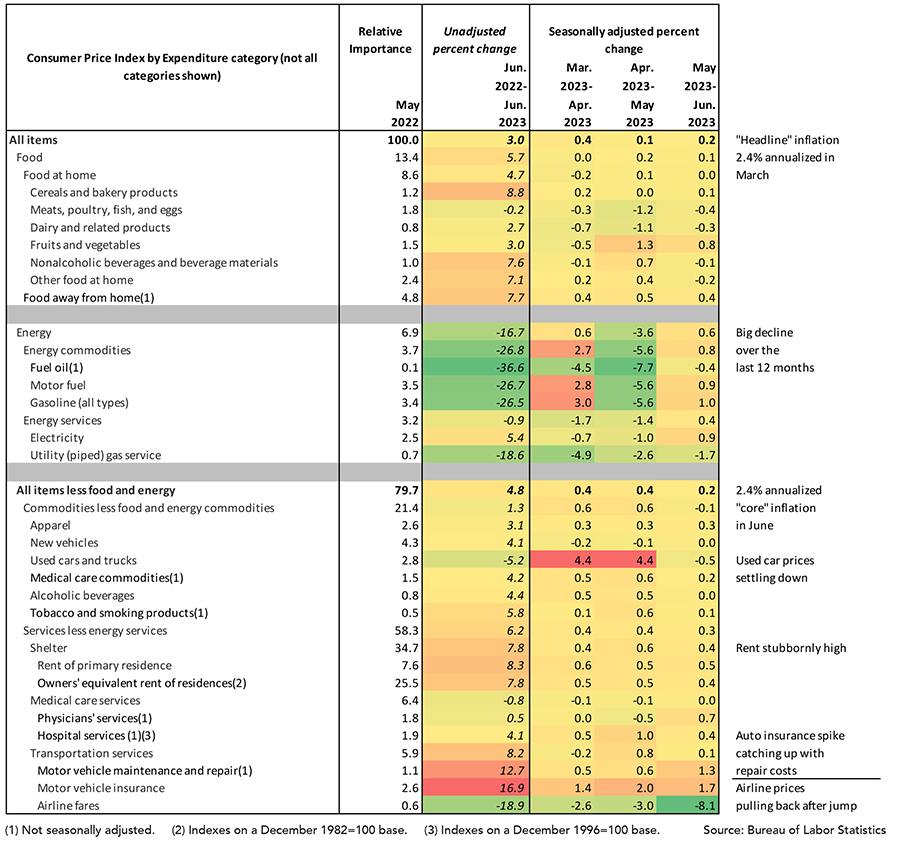

As figure 4 shows, the CPI rose by only 3.0% from June 2022 to June 2023. Not only was this the lowest growth rate since March 2021, but it was also slightly lower than economists’ expectations. The largest contributor to the moderating rate was energy prices, which fell almost 17% from June 2022.

If there is a cloud to this silver lining, it’s that the “core” measure of inflation (which excludes food and energy and includes 80% of the CPI) rose 4.8% year-over-year. This is still lower than the recent trend but seems to be a bit more stubborn than the more volatile food and energy prices (which is why economists pay more attention to the core number than the overall number). Although we are spotting more “move-in specials” for apartments, rent growth is still steep at 8% year-over-year. Rent growth is a bit slower to react than other categories, and it also has a highly visible impact on people, which can affect consumer sentiment more than other categories.

The Fed has “paused” – now what?

In another well-telegraphed event, the Federal Reserve Board of Governors made good on its expected “pause” in interest rate increases at the last meeting but left the door open for another 0.25% increase on July 25th. This “stop-start” pattern seems odd, but the economy over the past four years has been equally odd, and Chairman Jerome Powell is plowing new ground. As we noted above, plunging inflation sometimes obscures worrying price increases underneath the surface, and we’re sure that the Fed has noted the stubbornly high Core CPI as much as we have.

One of the unwritten rules of economic policy is that the Federal Reserve can only fix high inflation by causing a recession. Paul Volcker crushed inflation in the early 80s by triggering the ultimate “hard landing” – a “double dip” recession that lingered until Ronald Reagan’s second term. Of course, inflation was extremely high and the Fed raised short-term interest rates to over 14% to solve the problem. It’s hard to have persistent inflation when unemployment is 10%.

However, conditions in 2023 are different from 1979. The economy continues to plod along at a middling pace, with some economic indicators going into negative territory, but others staying above water, and most economists expect at least a mild recession either at the end of 2023 or the beginning of 2024. However, unemployment is still at 4%, and airports and restaurants are packed.

It’s a race between two turtles – inflation that is oozing its way downward (but with some stubbornly high factors, as discussed above) and an economy that is also losing a tiny bit of steam every month. Should inflation cross the finish line first, then the Fed might take their foot off the brake, which could possibly keep GDP from going into negative territory. If inflation stays high, then we believe that the Fed will be willing to accept a recession in exchange for putting inflation to bed. It’s too close to call right now.

While we wouldn’t discount another raise after July (assuming they raise rates in July) we don’t expect the steady stairstep of rate increases quarter after quarter like we had in recent years, especially since banks are slowing their loan activity. Hopefully a more subdued Fed will lead to a more stable interest rate and/or market environment. Based on the recent stock market performance, investors appear to be expecting this increased stability, but, as we have learned the hard way over the years, short-term forecasts are effectively impossible, so we remain committed to the boring principles of a) having a solid financial plan (and asset allocation to match the plan); b) broad diversification; and c) investing in high quality companies.

We hope everyone stays cool this Summer, and please contact us if you have any questions.

Figure 4: Selected Components of the Consumer Price Index (CPI), June 2023